Section 110 Tax Deduction

Amount B from Working Sheet HK-6. The purpose of the deduction is to bring the effective tax rate on stock option income to the same rate as.

Taxation Principles Dividend Interest Rental Royalty And Other So

Section 110 of the National Historic Preservation Act hereinafter referred to as NHPA or the Act sets out the broad historic preservation responsibilities of Federal agencies and is intended to ensure that historic preservation is fully integrated into the ongoing programs of all Federal agencies.

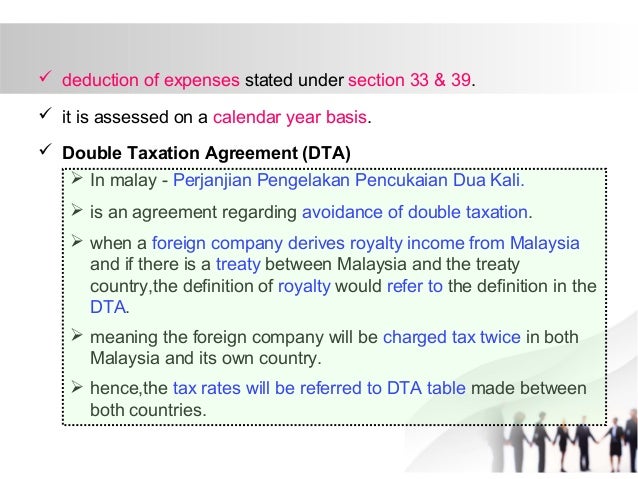

Section 110 tax deduction. Received under a short-term lease of retail space and. HK-6 Tax Deduction under Section 110 Others HK-8 Claim for Section 132 Tax Relief - Income from Countries With Double Taxation Agreement HK-9 Claim for Section 133 Tax Relief - Income from Countries Without Double Taxation Agreement HK-11 Basis Year Payment to Non-residents Withholding Tax 3. 110 allows tenants to exclude from income any amount received in cash as a construction allowance from the owner or treated as a reduction in rent.

Section 110 TCA 1997 was initially introduced by FA 1991 to promote securitisation for the financial sector operating within the State. The SPV pays no Irish taxes VAT or duties. It allows for organisations to achieve a neutral tax position provided certain conditions are met.

Section 110 Tax Deduction. But only to the extent that such amount does not exceed the amount expended by. 1 Section 110 of the principal Act prior to the amendment of that section under this Act shall apply to a person other than an offshore company excluding chargeable offshore company in respect of any tax deducted under this Part.

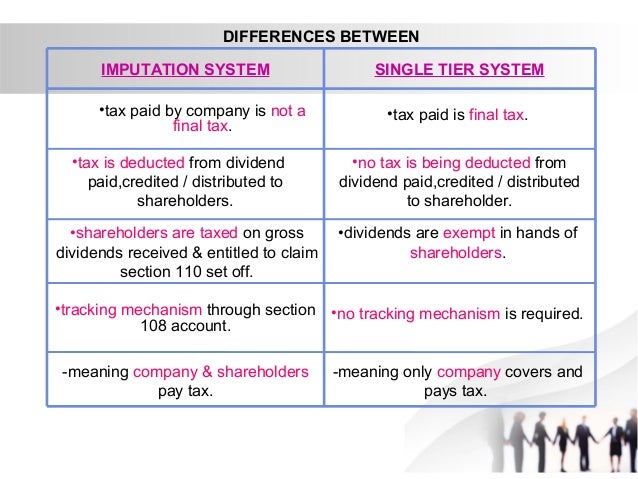

Tax is deducted from dividend paid credited or distributed to shareholders. Section 110 is at the heart of Irelands structured finance regime. This regime which has been in existence since 1991 is widely used and internationally regarded.

It was designed as a tax neutral regime for securitisation transactions. Dividends are exempt in the hands of shareholders. If Section 110 applies the Tenant can exclude the 500000 from income but the Landlord would be required to recover the 500000 over the longer recovery period of 39 years.

Year of Assessment Z 1 10 9 8 7 6 5 4 3 2 TOT AL B. This safe-harbor exclusion applies if the allowance is. Section 1101d Deduction Taxpayers w ho have earne d income wit h respect to stoc k options are a llowed to claim a deduction in the same year provided certain conditions are met.

Total gross interest income income code 3 D. Code Name of Payer Gross Tax Deducted Date of Receipt Trust Body Income RM RM sen Payment No. Total gross royalty income income code 5.

C4 SECTION 132 TAX RELIEF. Under paragraph 110 1 d the optionee can deduct 50 of the employment benefit where the exercise price of the options is no less than the fair market value of the shares at the time the options were granted and the shares qualify as prescribed shares when the options are exercised and the shares are issued. An Irish Section 110 special purpose vehicle or section 110 company is an Irish tax resident company which qualifies under Section 110 of the Irish Taxes Consolidation Act 1997 for a special tax regime that enables the SPV to attain tax neutrality.

C3 SECTION 110 TAX DEDUCTION OTHERS Amount B from Working Sheet HK-6 Working Sheet HK-6 must be furnished with the Form TA if the trust body is entitled to a tax refund as per item C8 pertaining to the claim for section 110 tax deduction on other relevant income. Section 110 tax deduction others does NOT include withholding tax payment pursuant to Section 107 A of ITA 1967. For more information and source see on this link.

Section 110 was created in 1997 to help International Financial Services Centre legal and accounting firms. Shareholders are taxed on gross dividends received and entitled to claim section 110 set-off. Obviously under either scenario both the Landlord and the Tenant need to be aware of the tax implications of the options and negotiate accordingly.

Code 110 - Qualified lessee construction allowances for short-term leases. Provided that that person shall. No tax is being deducted from dividend paid credited or distributed to shareholders.

Please submit Working Sheet HK-6 if you are entitled to a tax refund. Appendix A11 as a reminder on. Total tax deducted under section 110 others C.

1Any input tax evidenced by a VAT invoice or official receipt issued in accordance with Section 113 hereof on the following transactions shall be creditable against the output tax. TAX DEDUCTION UNDER SECTION 110 OTHERS No. APurchase or importation of goods.

Stock Based Compensation Back To Basics

Section 110 Company Everything You Need To Know Nathan Trust Corporate Governance Company Law

Qualifying Expenses For The Expanded Research And Development Credit The Cpa Journal

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps

Http Www Hasil Gov My Pdf Pdfam Explanatorynotes Ta2008 2 Pdf

Earnings Stripping Effective Tax Strategy To Repatriate Earnings In A Global Economy

Posting Komentar untuk "Section 110 Tax Deduction"